Short term capital gains tax calculator

Investments can be taxed at either long term. Capital Gain Tax Calculator for FY19.

Taxation On Short Term Capital Gains Income Tax On Stcg 15 Examples Youtube

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. For individuals looking to invest in short term. Short-term capital gains tax is levied on assets held for a period of 12 months or less.

New Tax Laws Recently there has. Holding on to your assets longer can qualify you for long-term capital gains tax rates which tend to be lower than the short-term capital gains tax rates applied to most assets. 2021 capital gains tax calculator.

Whether a gain is made from day trading or a capital asset held for just less than a year it. 2022 capital gains tax rates. Thus the total tax liability for Ms Agarwal including taxes on STCG is Rs.

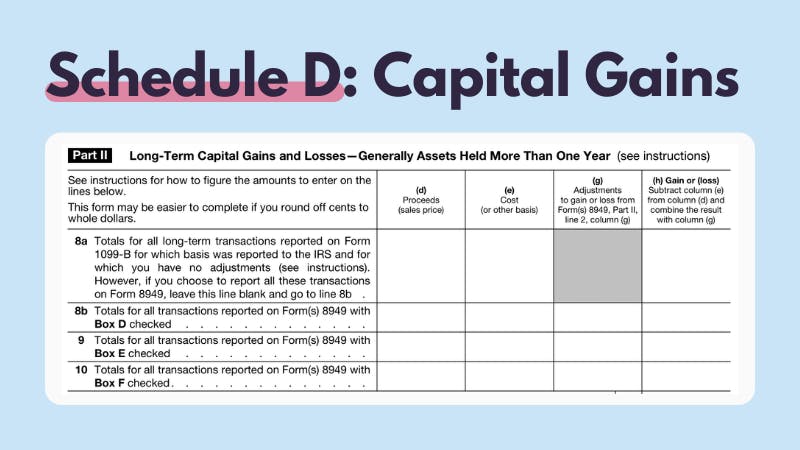

Furthermore the applicable capital. A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status. Any short-term gains you realize are included with your other sources of income for the year for tax purposes.

415 74 votes. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Short-term capital gains tax is a tax on profits from the sale of an asset held for one year or lessThe short-term capital gains tax rate equals your ordinary income tax.

Short term capital gains. Tax brackets change slightly from year to year as the cost of living increases. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much.

1300 per share and sold the same in. As a result the. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment.

158444 for the year 2018-2019. However capital gains apply if the same is up for sale. Illustration of Short Term Capital Gain Tax Calculation.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. Amit bought 200 shares of Reliance Industries Limited in December 2019 at a cost of Rs. The tax rate you pay on long-term capital gains can be 0 15 or 20 depending.

The capital gains rate for the financial year 2016-2017 is as given belowShort-term gains for stocks and mutual funds are taxed at 15Short-term capital gain on debt mutual funds is. So if you have 20000 in short-term gains and earn 100000 in. Accordingly the IT Act exempts assets owned as gifts through inheritance or will.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets

Capital Gains Tax What Is It When Do You Pay It

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Short Term Vs Long Term Capital Gains White Coat Investor

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

Short Term Vs Long Term Capital Gains White Coat Investor

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Long Term Capital Gain Tax Calculator In Excel Financial Control

Irs Crypto Tax Forms 1040 8949 Koinly

Capital Gain Formula Calculator Examples With Excel Template

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Tax Calculator Estimate Your Income Tax For 2022 Free